Recently, there are some new signs in China’s

economy revealed by macro and micro data, which offer us a chance to find out

the real situation of China’s economy and are important for allocating assets in

the future.

Source: Internet

1. Strong production yet weak demand,

positive micro data yet negative macro data: What’s the real situation of China’s

economy?

On one hand, there is a decline of growth

rate both in investment and social credit financing. In July, new loan

increment of RMB reached to RMB463.6 billion, RMB1.01 trillion less increase

YoY. Since the beginning of this year, investment growth rate keeps falling,

with manufacture investment and private investment dropping largely. In

particular, the growth rate of private investment in July turned negative YoY.

On the other hand, sales of real estate get

heated, orders of PPP (Public- Private Partnership) grow greatly, industrial

production keeps stable, the consumption of coal for generating electricity

stays high, the production of crude steel climbs higher, the prices of cement

and glass rebound, the sales of engineering machines boost, and the enterprise

profits, especially in the cyclical industries, improve more than anticipated.

In August, the growth rate of coal consumption for power generation was 8.7%, a

slight increase compared with 7.1% in July. In the first seven months of this

year, the total profits made by industrial enterprises above designated size

rose by 6.9%, 0.7% higher than that in H1 2016. In particular, the growth rate of

profit in July reached to 11%. What’s more, the sales figure of excavator in

August was 4,370, up by 44.9% YoY.

So we think the economy in real condition

operates better than that reflected by macro data though the figures of social

credit financing and investment appeared negative. There was probably a small

cyclical re-rise in H1 2016 and the economy is in a stabilized state of L-shape

development at present.

2. Several proofs for L-Shape Economy

In 2015, we once put forward that as the

real estate investment touched the bottom, China’s economy development would be

like L-shape for a long time.

This year, the macro economy operation basically

verifies our prediction about L-shape economy: heated sales of real estates and

lands, strong support from PPP, over expectation of supply shrink, the end of

de-stocking as well as the rebound of commodity prices.

2.1 Sales of real estate getting heated

In the background of money over issue, low

interest and policy encouraging people to use leverage, the sales of real

estate from 2014 to 2016 get boomed, pushing the housing price to rocket.

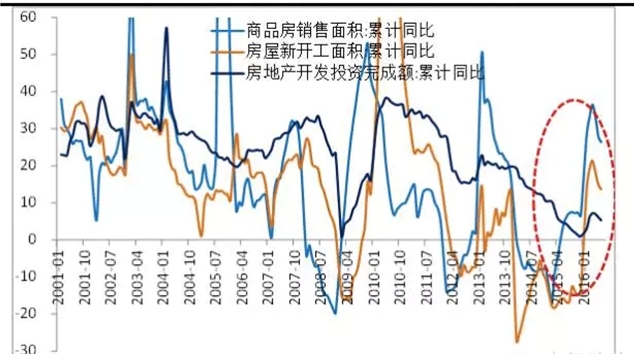

The hot sales of real estate drive other

relative investment and consumption. In the first seven months, accumulated

sales of commercial housing grew by 26.4%, newly started floor space rose by

13.7% YoY and investment of real estate development increased by 5.3%, all of

which enjoyed a large rebound compared with that in 2015. Besides, the hot

sales of real estate drive other relative consumption, such as decoration, building

materials, furniture and appliance.

Graph1: Sales on real-estate market in

China (Unit: %)

Sales areas of apartments: YoY

changes

New construction

areas of apartments: YoY changes

Completion of development and

investment on real-estate market: YoY changes

Source: Founder Securities

2.2 Strong support from PPP and the orders

of capital construction rocketing

Recently, there are three issues that are

over expectation about PPP: policy, practice and company performance.

Constricted by booming price of real

estate, policy of de-leverage and expectation for raising interest rate by FED,

recent monetary policy returns to neutral and prudent. In 2014 and 2015, the

monetary policy leaded in the policy mix. But this year, the fiscal policy,

which functions more in stabilizing economy growth, is placed in a more

important position. There are usually two ways for its direction: one is to

enlarge budgetary deficit (yet the deficit rate has reached to 3% this year);

the other is to seek other sources of fund (PPP is a very important approach). Under

the encouragement of the State Council, local governments, banks and

enterprises involve actively, pushing the practice of PPP model. In the

background of asset shortage and long-term interest rate going down, the will

to get into PPP for other capitals increases evidently. And it’s expected that

the government may offer some policy benefits, such as tax reduction, fiscal

subsidy and project screening.

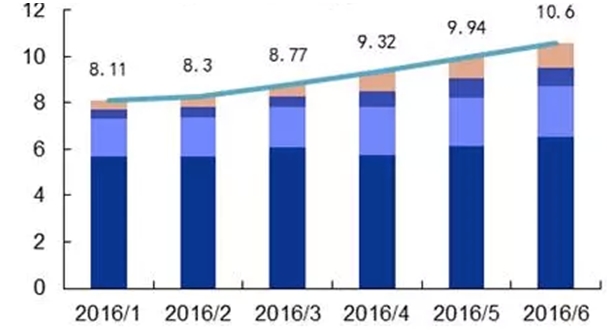

The project scale keeps growing. Since

2016, the demand for PPP projects continues to go up. According to the data

from PPP integrated information platform, the figures of programs and total

investment reached to 9,285 and RMB10.6 trillion at the end of June, up by

32.70% and 30.70% compared with that at the end of January.

Graph2: Investment volume of PPP projects

in 2016 (Unit: trillion RMB)

Execution

phase; Purchase

phase; Preparation phase; Recognition phase; Total

Source: China’s Ministry of Finance, Founder

Securities

Policies are introduced intensively. Since

the concept of PPP and the framework guidance opinions for its development

model were put forward officially by Ministry of Finance in 2014, the PPP

projects were spread gradually in China. In 2015, more relative policies were

introduced, covering guidance on project operation, mechanism of investment and

financing, planning of fiscal budget, evaluation of project and distribution of

rights and responsibility. With the support of these policies, this year is

expected to witness the accelerated practice of PPP projects.

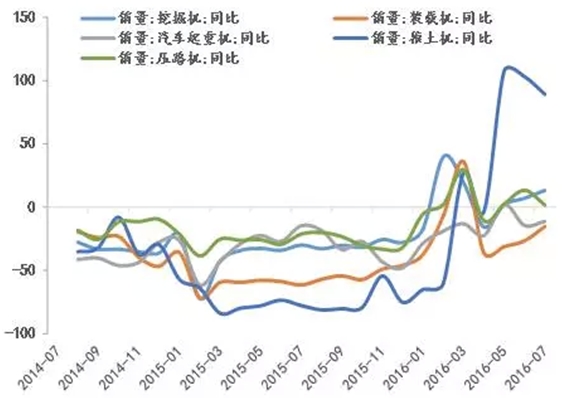

The increase of PPP manufacture orders also

can be proved by much more sales of engineering machine. According to the data

from Chinese Construction Machinery Business Network, the sales figure of

excavator in August reached to 4,370, up by 44.9% YoY and 19.3% MoM. From the

perspective of product types, the sales of both large-sized excavator and small-sized

excavator achieved rapid growth, with the former increasing by 69.6% and the

latter rising by 56.8% YoY. In general, large-sized one is mainly used to

mining and large-scale capital construction while small-sized one to municipal

engineering, park and garden construction, real estate development and so on.

So it’s inferred that the price rise of black-series and nonferrous metal

pushed the upturn of mining, and the urban infrastructure and PPP projects

boosted sales of excavator.

Graph3: Sales of construction machinery in

China

Sales of excavator: YoY change Sales of

truck crane: YoY change

Sales of loader: YoY

change Sales of road roller:

YoY change

Sales of bulldozer: YoY change

Source: Founder Securities

2.3 Excess capacity is cut cyclically and

administratively, and supply side was shrinked more than expectation

In G20 Meeting, President Xi Jinping,

pointed out that China has made every effort to reduce excess capacity as it

announced before. Resolving overcapacity is a major task for supply-side

reform. From 2016, China plans to reduce crude steel production by 100 million

- 150 million tonnes within 5 years, and decrease capacity of coal by 500

million tonnes, and lessen 500 million tonnes of coal by restructuring in 3 to

5 years. What’s more, the State Council will supervise the process of cutting

excess capacity from place to place in the second half of the year.

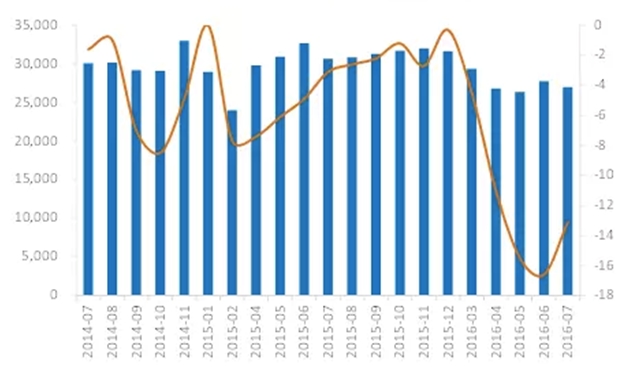

Various kinds of signs indicate the

positive progress in shrinking supply side, especially in coal industry. In

2016, the production of coal dropped evidently, with the production being 268

million, 263 million, 277 million and 270 million tonnes from April to July and

down by 11%, 15.5%, 16.6% and 13.1% YoY, respectively, thus pushing up the

reduction of inventory and the rise of price. Besides, the stock of cement

showed a downtrend compared with that at the beginning of the year. The

production of crude steel was 804 million tonnes in 2015, down by 2.3% YoY,

marking the first time to be down in the past 10 years. Virgin Aluminum, a kind

of nonferrous metal, experienced an evident decline in production since H2

2015.

Governments at all levels carry out the

plan of reducing excess capacity strictly. In Shanxi province, 15 coal mines

will be shut down, cutting the coal production of 10.6 million tonnes per year.

Hebei province also publicized the elimination list, involving 16 million

tonnes of ironmaking production from 39 iron and steel enterprises. Besides,

Henan province declared that iron and steel industry should complete the

mission of cutting excess capacity by the end of October, and the coal industry

by the end of November. The State-owned Assets Supervision and Administration

Commission have set the capacity-reduction schedule for central enterprises,

requiring the central enterprises cut 10% of the excess capacity within two

years, and clearing 345 large and medium-sized zombie enterprises within 3

years.

Graph4: Output of coal in China

Output of coal; Output of coal: MoM change

Source: Founder Securities

2.4 Price of commodity rebounding, company performance

improving

After two years’ decline, the price of

commodity began to rebound since early 2016, improving some companies’

financial performance. The increase can be attributed to the end of de-stocking

process, heated real estate investment and sales, the support of PPP and the

cyclical and administrative capacity reduction.

In August, PPI went down by 0.8% YoY, but

rose by 4.5% compared with that at the beginning of this year, and the figure

is expected to turn positive in Q4 2016. What’s more, the price of some cycle

commodities, including steel, coal, cement, glass, crude oil and zinc,

rebounded.

The

total profit of industrial enterprises above designated size in the seven

months of this year rose by 6.9% YoY, 0.7% higher than that in the first half

year, with the profit in July reaching to 11%. Within

it, the iron and steel industry and nonferrous metal industry contributed a

lot.

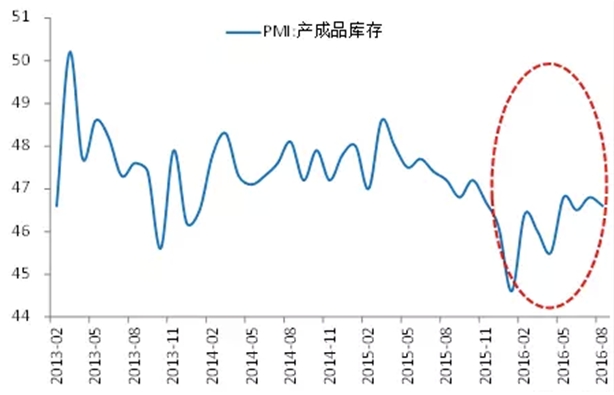

Graph5: Finished goods inventory index in

China (%)

Finished goods inventory index

Source: Founder Securities

*The

article is edited and translated by CCM. The original one comes from Laohucaijing.com.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For

more information about CCM, please visit www.cnchemicals.com or

get in touch with us directly by emailing econtact@cnchemicals.com or

calling +86-20-37616606.